Which Type of Car Insurance is Your Soulmate?

Regardless of the make or size of the model you drive, there’s one thing that applies to all car owners – the need to have insurance. Although all drivers are legally-bound to possess adequate cover, it’d be a mistake to think that all policies will provide exactly the same level of protection. Indeed, as there are a wide range of products to choose from, you need be sure that you get one suitable for you.

It can, however, be a little bit confusing to know exactly the amount of cover each plan offers. To help make things easier, here’s a look at some of the types of car insurance you can choose from.

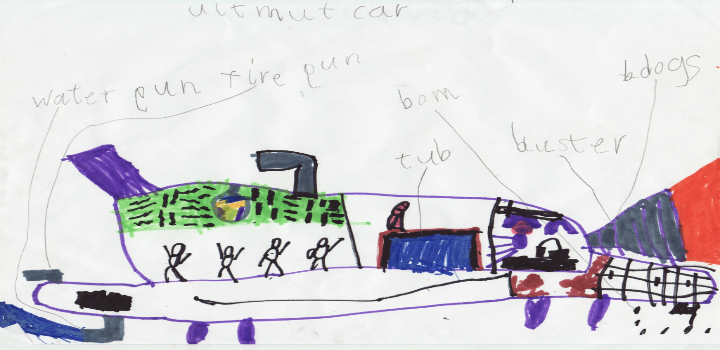

“Even the ultimate car needs insurance”. Dream cars designed by children by Admiral Car Insurance, on Flickr. This work is licensed under a Creative Commons Attribution-ShareAlike 3.0 Unported License.

Prestige Car Insurance

Whether you own a lovingly-restored classic 1950s car or have the latest sports model, if you own a high-powered or exceptionally-expensive vehicle you’ll need to take out specialist car insurance, or prestige car insurance as it’s also known.

The high net worth value of such models means many standard insurers will simply refuse to insure them – largely because the financial cost attached to repairing or replacing these vehicles is deemed to be prohibitive – so you’re better off seeking out a tailor-made policy. Depending on the plan you get, you can have repairs carried out by the garage of your choice and the bill for this work should not have to be paid from your own pocket.

European Car Insurance

Whether you go away for business or pleasure, you should always make sure that you have a comprehensive level of insurance if you plan on driving in Europe. Indeed, only having the bare minimum amount of protection may mean you have to pay an extortionate amount of money for repairs if you end up having a breakdown while abroad. Finding someone to fix your vehicle could be even more difficult if you’re not too familiar with the local language.

Take out European car insurance, however, and you cannot only be confident that you’ll be meeting the motoring laws of all the countries you’re driving in, but can also quickly get in touch with a roadside repair team in the event you break down or have an accident. Although protection for driving on European roads is often already incorporated into a prestige cover plan, you should always check that the specific level of cover provided is right for you.

Multi-Car Insurance

If you’re lucky enough to own more than one car, it’s important to make sure that each vehicle is insured. What that doesn’t mean, however, is having to take out an individual policy for each one.

The process of getting quotes for multiple cars from multiple insurance companies can be time-consuming and frustrating, and it’s often better to go for a multi-car insurance policy. Not only will this automatically provide comprehensive cover for all the vehicles you own, but it also means that you only have to speak to one organization whenever you need to make an amendment or review your insurance.

As you can see, there are many different kinds of car insurance to choose from – we’ve only scraped the surface with the ones that we’ve looked at above – so it’s vital you get the policy that is right for your needs.

This is where the services of brokers, such as Certis Insurance, can come in handy. Speaking to such experts enables them to get an exact idea about the level of protection you would like for your car (or cars), and from there, they will work with specialist insurers to arrange a bespoke plan that suits your requirements perfectly.