Comparing Payday Loans to Bank Overdrafts

Have you ever sat down and taken the time to compare a payday loan to an overdraft? Here is some news that might just shock you, given all the bad publicity surrounding payday loans – a payday loan can be cheaper than an overdraft. Read on to find out how a bank overdraft can leave you worse off than a payday loan, so you, too can join the debate on payday loans.

Payday Loans or Bank Overdrafts

Research conducted by the consumer group, Which? recently compared getting a payday loan to getting an overdraft from Barclays, the Halifax or some other high street bank. The result? Borrowing £100 from the Halifax for 31 days costs you between £20 and £30 for 31 days. Getting a payday loan for one month costs between £20 and £37. So, this makes the payday loan and the overdraft pretty comparable right? Wrong. If you go into an unauthorized overdraft with the Halifax, Santander or many of the other high street banks, this could end up costing you oodles of cash in charges, fees and increased interest rates (which banks charge when you go over your authorized overdraft limit).

The resulting debate has highlighted how payday lenders have been treated unfairly in the press. The reality of payday lending is that it is not much different from other forms of lending, so the amount of criticism heaped on payday lenders can be seen as disproportionate and even unfair.

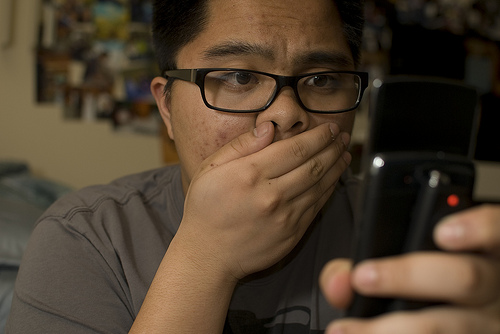

“Overdraft shock, this is!”. 16/365 by rafael-castillo, on Flickr. This work is licensed under a Creative Commons Attribution 3.0 Unported License.

Think for Yourself

This just goes to show the value of thinking for yourself. When you require finance you should consider all of your options, not just the ones you are familiar with or which feel ‘safe’ as you have done them before. A payday loan might be a better option than an overdraft depending on your circumstances and how you plan to repay the loan, so it always pays to do your homework.

For people who warn that payday loans are to be avoided, it is useful to remember the following fact. Sometimes avoiding a payday loan and going for the more ‘conservative’ option of an overdraft or a credit card is a false economy, especially if it is an emergency and you find you have to flog the TV, which cost £500 for £50, only to find that you have to pay £750 to get a new one at the end of the month.

Picsues / Pixabay

The upshot of this discussion really is not to be swayed by media reports which suggest that certain sectors or groups of people are being targeted unfairly or ‘victimized’. All reputable lenders seek to make a legitimate profit and that includes many lenders who have been around for years, as well as ‘new kid in town’ lenders like, Wizzcash.

So, there you have it, payday loans can actually be cheaper than overdrafts. Sometimes the best option for you is the one you think of for yourself, so maybe you should give payday lenders a break and really think about the finance option that is right for you?