What Businesses Should Know About Check Fraud

Is your business vulnerable to check fraud? Although check use has declined, check fraud still accounts for 45 percent of all money lost to payment fraud. Sometimes the crime is unintentional — it’s easy to make a mistake and write a bad check if you’re not tracking your checkbook balance carefully. But fraud also includes everything from a desperate customer floating a check and hoping to deposit the funds before it clears to serious crimes like identity theft, counterfeiting, and forgery. Regardless of the intent of the customer, check fraud costs businesses money. Here are some ways to protect yourself.

Spot Fake Checks

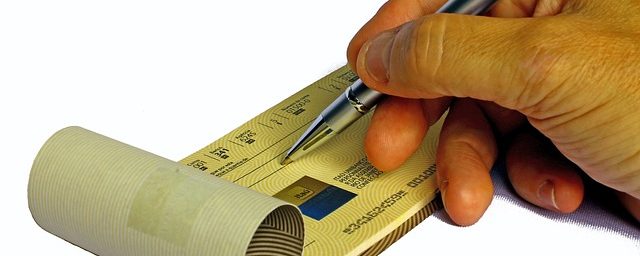

Image via Flickr by Got Credit

Counterfeit checks aren’t always easy to spot, but experts advise training your staff to watch for a few key indicators, including the following:

- Checks without perforations

- Low check numbers (below 400 on personal accounts or 1500 on business checks)

- The account holder’s name is printed in a different font than the address

- Stains or discolorations that could be caused by erasing or altering the check

- Missing info (customer or bank address, check number)

- MICR numbers along bottom of check are shiny (they should be dull)

- Final digits of MICR encoding and check number don’t match

- Signature is missing or check isn’t dated properly

Make Sure Funds Are Available

Sometimes the check is real, but there’s no money in the account. How can you protect yourself from this type of fraud? If your business receives a lot of check payments, consider adding a merchant check reader to your payment processing options. These devices scan the MICR data at the bottom of the check. A check reader can warn you if there’s a problem with a check, and some of them will convert the check transaction into an electronic transaction and process the payment instantly as if the check were a debit card.

Watch Your Own Checks

Customer payments aren’t the only source of check fraud risk for businesses. A criminal could duplicate, forge, or alter your checks and wreak havoc on your account. Protect yourself with secure voucher checks that offer advanced security features like security holograms that make the checks impossible to duplicate and a tamper-resistant security coating that makes any changes to the payee or amount instantly obvious.

Be Alert for Scams

One of the most common scams to target small businesses is the check overpayment scam. A con artist will contact you offering you a huge and highly profitable sale. The scam begins when you are sent a payment by cashier’s check that is way more than you’re owed. You’ll then receive a very apologetic message saying that you were given money urgently owed to a different vendor, and can you please deposit that payment immediately and wire some of the funds to someone else. With a giant check in your hand, it’s hard to say no, but later you’ll discover that while the cashier’s check was a fake, your wire was real and your account is now hopelessly overdrawn.

Checks offer a convenient way to pay bills and transact business, but that convenience comes with a high risk of fraud. The best prevention is awareness and education for yourself and your staff.